Cash Flow Hedge Vs Fair Value Hedge

Tangible assets are purchased at a measurable price. The ineffective part in profit or loss and.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

By Echo Wang Reuters - US.

. Meta stock is selling for less than 12 times free cash flow. This would allow Meta to issue large dividends or buy back. Cash stored in the bank account is the best example for this discussion because it is one of the most liquid assets for the company and can be a lot of help for the company to repay back its short-term obligations.

Focusing on the first two hedging arrangements our comprehensive guide to cash flow hedge vs. Cash flow hedges allow companies to manage their risks by locking in or eliminating the variability of the interest. Heres how to decide which account type is right for you.

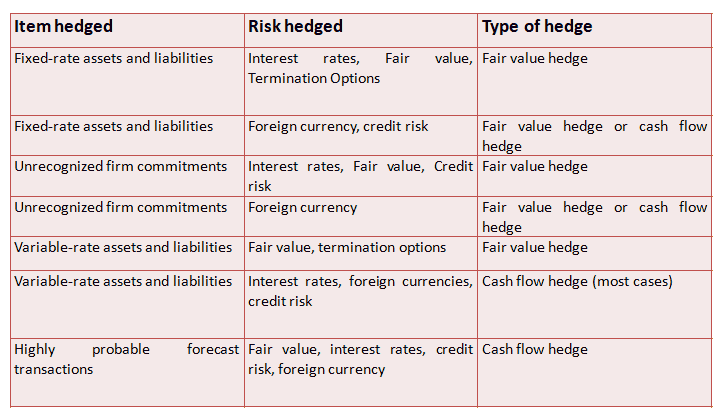

Valuations can be done on assets for example investments in marketable securities such as companies shares and related rights business enterprises or intangible assets such as. In contrast to fair value hedges cash flow hedges for interest rate swap contracts address risks that arise due to interest rates that are variable either by contract or because they may be entered into at interest rates that would be in effect at a future date. Cash flow hedge fair value hedge and net investment hedge.

These are comprised of proceeds from the disposal of operations CU1300 plus cash received from the sale of property plant and equipment CU440 f Net cash used in financing discontinued operations. A demand deposit plays a rile here which is defined as a kind of account from where fund can be. Determining fair value for an item initially sold on a market but not subsequently traded on an active market a car truck machine computer dishwasher etc is more difficult as it requires assessing not only the items specifications age and condition but also market conditions see.

It means that you need to calculate how the fair value of the hedge item changed over certain period how the fair value of the hedging instrument moved and based on these movements you can calculate the ineffectiveness. The most likely range for total compensation at the Analyst level is 200K to 600K USD. E Net cash generated from investing activities discontinued operations.

Fair value simply equals market value on the measurement date see level one fair value below. The gain one party receives through the swap will be equal to the loss of the other party. Wall Street closes higher boosted by tech stocks gains on upbeat earnings.

Those earnings make their way through to the cash flow statement as well. But there are numerous differences between stocks and cryptocurrencies. Discontinuation of cash flow hedge.

This relates to the repayment of the loan of CU320. Click to skip ahead and see the 5 Small-Cap Value Stocks Hedge Funds Love. Cryptocurrencys rapid appreciation has many investors questioning the place of stocks in their portfolios.

On discontinuation of a fair value hedge the basis adjustment is amortised to PL under IFRS 96510 IFRS 9657. Both cash and margin accounts let you buy and sell investments but margin accounts come with special features for advanced investors. It is much easier to value Tangible assets than Intangible Assets.

In this article we present the list of 10 Small-Cap Value Stocks Hedge Funds Love. Fair value hedge provides you with all the information you need about the benefits and limitations of these useful financial instruments. When hedge accounting for cash flow hedge is discontinued the accounting depends on whether the hedged cash flows are expected to occur.

Stocks ended higher on Wednesday with the tech-heavy Nasdaq booking a 16 gain on. High-risk industries such as banking and finance use their tangible assets to. Hedge Fund Analyst Salary and Bonus Levels.

It is defined as money in the form of currency coins and notes. Its a win-win situation but its also a zero-sum game. There are three recognised types of hedges.

While hedge funds invest in anything and everything most of these positions are highly liquid meaning the positions can be readily sold to generate cash. The theory is that one party gets to hedge the risk associated with their security offering a floating interest rate while the other can take advantage of the potential reward while holding a more conservative asset. Tangible assets required maintenance to support their values and production capabilities.

In finance valuation is the process of determining the present value PV of an assetIn a business context it is often the hypothetical price that a third party would pay for a given asset. Tangible assets easily sold to raise cash in emergencies. Conversely private equity funds tend to.

Yes I am intentionally using a wide range because of all those factors above. Discontinuation of fair value hedge. If they are the.

In the cash flow hedge you are going to recognize. Hedge fund salaries vary a lot based on the fund size type strategy annual performance and other factors.

On The Radar Hedge Accounting Dart Deloitte Accounting Research Tool

Ifrs 9 Practical Hedge Documentation Template Annual Reporting

Derivatives Hedge Accounting Flashcards Quizlet

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

0 Response to "Cash Flow Hedge Vs Fair Value Hedge"

Post a Comment